I sincerely considered people taking out a loan for an apartment in domestic banks for 30 years suicidal, but this is a very soft word to describe what a mortgage loan really is if you look at it through the prism of naked mathematics. And the Wolfram Alpha calculator will help us in this.

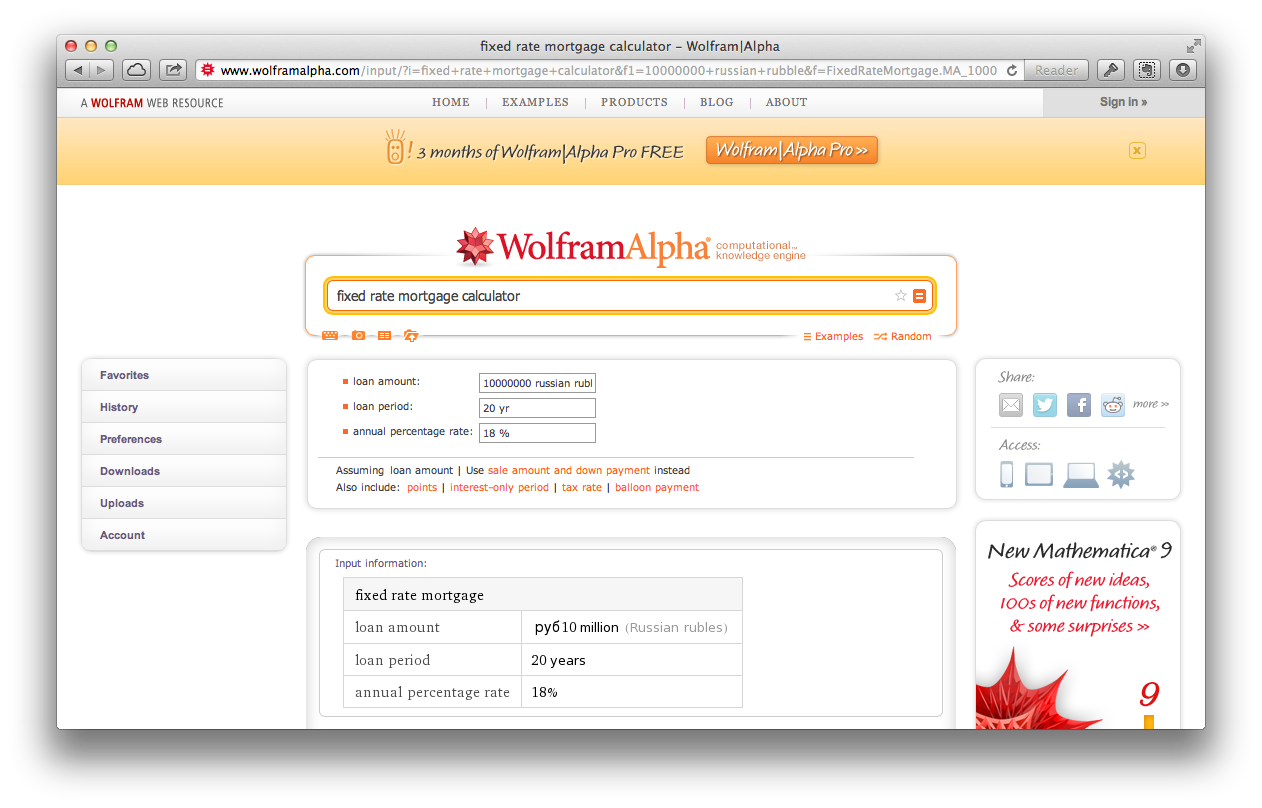

To understand how much you will actually pay the bank for a loan taken for 20 years, for example, follow the link and enter the initial data.

For example, let's take an apartment for 10.000.000 rubles somewhere in Moscow. We will take the interest rate of 18% (you can substitute your rate in the calculator). The loan term is 20 years.

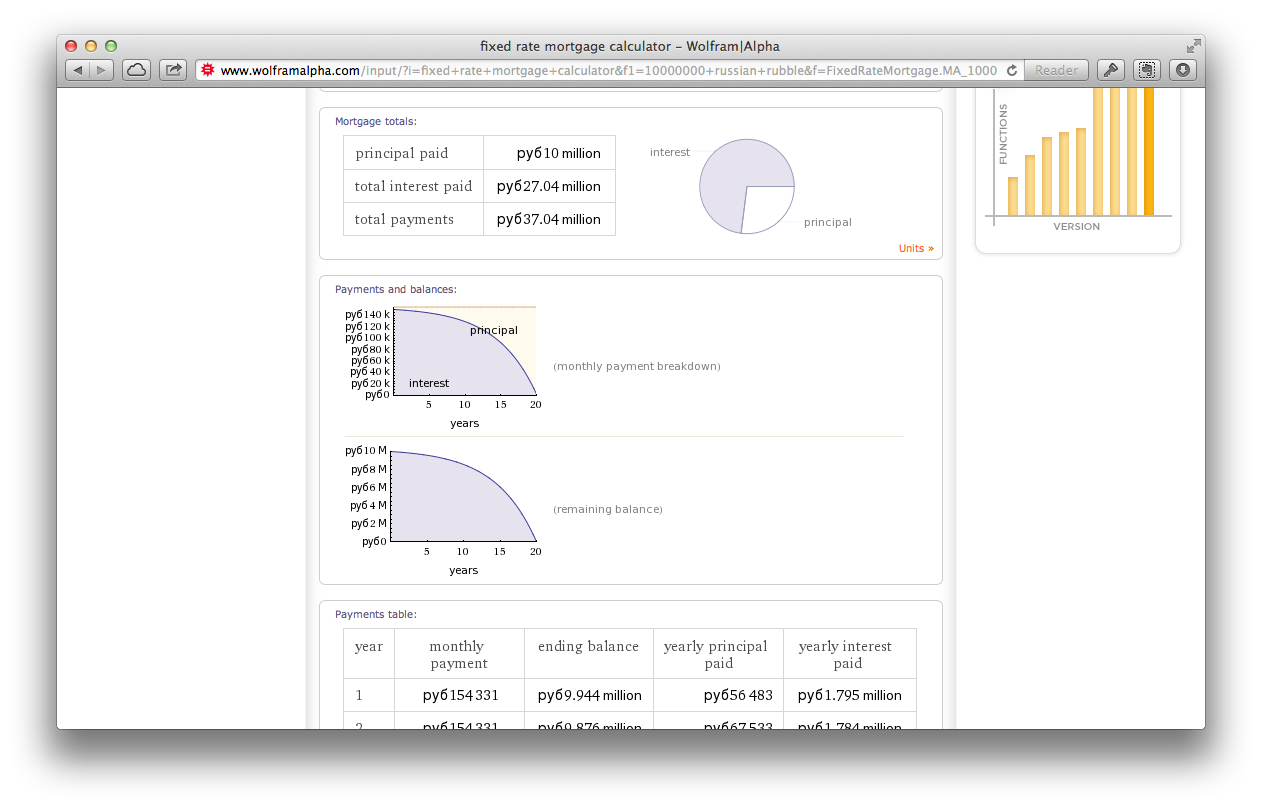

And here is the result:

If you decide to just save 10 million rubles by saving 154.331 rubles each month, then it will take you 65 months to accumulate money for the same apartment, or 5 years and 5 months.

If you take a loan for 30 years under the same conditions, then you pay the bank 54.260.000 rubles. This is a real suicide :)

That is, if, for example, you have a child and you explain to yourself the purchase of an apartment by this phenomenon, then paying the same money as with a loan for 20 years, you will buy the coveted apartment in just 5 and a half years! Plus, you are deprived of the risks of a jump in exchange rates, arbitrary changes in conditions by banks and much, much more that we have seen more than once.

What do you think about this?

Photo: Shutterstock