In this article, I will tell you about the simplest and most reasonable way to create retirement capital. This strategy is widely used in the West, and it is primarily thanks to savings that Europeans and Americans can afford to live well and travel in old age.

In Russia, it costs even less to rely on the pension system than in the West. This year, the accumulative part of pension contributions has been frozen once again, and another reform is planned. The average pension amount is about 13 thousand rubles, and there are no prerequisites that it will fundamentally change in the future, because the population is not getting younger.

Therefore, you need to take care of your well-being yourself. By starting to apply the approach that will be discussed today, you will take the first step on the road to wealth. Ignoring the need to create retirement capital, you will hardly be able to lead a decent lifestyle in the golden years.

There is no secret in this strategy. This is not a "super-duper way to get rich quickly" - it's better to stay away from such offers, you will only lose money. Also, you don't have to spend a lot of time and effort studying the subtleties and nuances of the stock market. This is an approach for people who are busy with their own affairs, which works and does not distract them with unnecessary fuss.

The basic idea is the principle of compound interest. If this sounds incomprehensible to you, don't worry. Everything is very simple.

Compound interest allows you to collect profit from the profit you received earlier. Let's take a closer look at how it works.

Imagine that you are 30 years old and you have 100 thousand rubles. You invest them in the MICEX index of Russian stocks. It includes shares of 50 largest Russian companies. By investing in the index, you immediately invest in a basket of stocks and reduce your risks if something bad happens to some company.

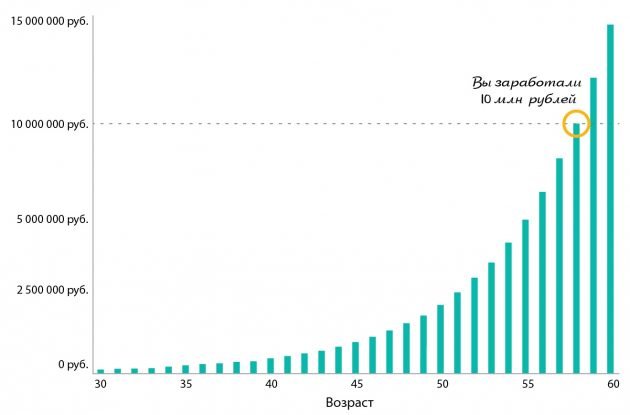

Over the past 16 years, the average yield of the MICEX index has been 18% per year. For a clear demonstration of the principle of compound interest, we will assume that our investment evenly brings 18% per year. How much money do you think you will have by the age of 58 — the average retirement age?

You will have 10 million rubles.

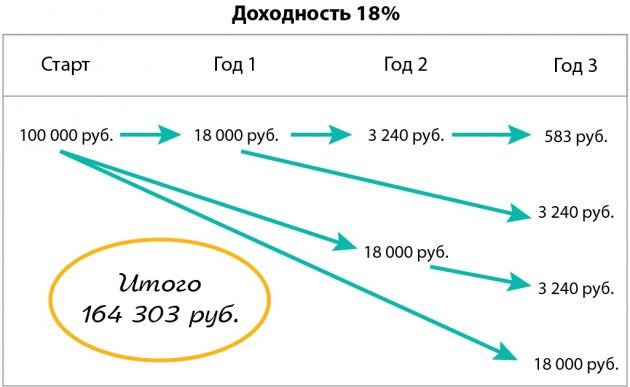

The calculation is simple. If you start investing with 100 thousand rubles, then by the end of the first year you will have 118 thousand (we do not take into account possible commissions). You have earned 18 thousand.

The second year you start not with 100 thousand. Those 18 thousand that you received in the first year will also bring you profit. Therefore, with a yield of 18%, you will earn 18 thousand from your initial 100 thousand plus 3,240 rubles from the profit of the first year.

To calculate how much money you will have in 28 years (we are considering an example of investing from 30 to 58 years), you do not just need to multiply 18 thousand by 28. This would give only 504 thousand. Where do the other 9.4 million come from? That's the secret. Money starts making money out of profit. Compound interest starts working.

The profit that you received for the first year (in our case, it is 18 thousand), in turn, begins to make a profit in the second year, the third, and so on. And so it happens with every piece of profit that you earn. Therefore, the 18 thousand that you received in the second year also gives you 3,240 rubles in the third.

But that's not all. These 3,240 rubles begin to bring 583 rubles each subsequent year. Look at the diagram to understand the principle. You will see that by the end of the third year you will already have 164,303 rubles.

And the money continues to increase. Take a look at the graph below. It shows how much you will have by the end of each year. By the age of 58, the total amount will be about 10 million rubles. And if you wait a couple more years, the growth will be explosive. By the age of 60, you will have almost 15 million.

Now you understand why it is so important to know the secret of compound interest. Your profit starts working on a par with the initial investment and eventually creates a fortune for you.

In conclusion, let's see what 15 million can give you in retirement. If the profitability remains at the level of 18%, then you will receive 2.7 million profit per year, that is, 225 thousand per month. I think this is a good addition to the state pension. Even if you transfer the 15 million earned on the stock market to the bank and receive interest, then in a month (consider the current rate of 9% per annum) you will have an income of about 110 thousand rubles.

Today I deliberately do not talk about inflation and other nuances in order to show the principle of compound interest in its purest form. Those of the readers who have already thought about it, please note that we achieved this result after a single investment of only 100 thousand rubles.

Successful investments for you!