We bring to your attention the wonderful material of our reader, which touches on a very sad, and therefore very relevant topic of personal finance. Many of you have loans that you repay regularly. But imagine that you have received a 13th salary, a Christmas Bonus or other pleasant additional income. What should I do with it? Spend it? Put on deposit or repay part of the loan over the plan? The answer to the question "what is more profitable" is given by the material below. Also in it you will find a clear credit calculator in Excel format.

I recently got some free money. And as always, when they arise, a pleasant problem arose – where to spend them? I immediately dismissed any useless purchases. I was wondering how they can be used more? Therefore, my choice stopped at two possible options:

Which of these is more profitable? And how much? At the same time, I was not interested in the moral side of the question: "how nice it is to have money on deposit.." or "it's good to live without loans." And purely economic.

So, what is given:

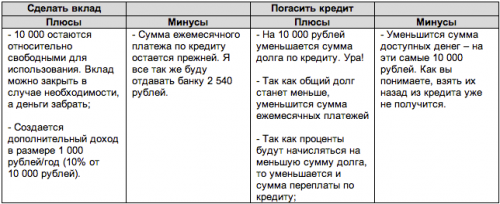

In both of these cases, something happens in our life. Let's try to understand what.

Now let's get to the most interesting part. Let's understand how much we will earn in both cases and what it will be enough for us.

To do this, let's try to calculate the income from our investments in the deposit and in the loan, the so-called ROI.

ROI is an indicator of the return on investment. Expressed in %. Implies a comparison of the amount of income from the investment and the amount of the investment itself. For example, I will put 10,000 rubles in the bank, and a year later I will get 11,000 rubles back. It turns out that I earned 1,000 rubles – this is my income. It is 10% of the amount of the initial investment. It is considered this way:

(Amount of income/The amount of the initial investment)×100% = (1 000/10 000)×100% = 0,1 × 100% = 10%

This indicator is needed in order to compare different investments and investments. Where the ROI is greater than 0, it is more profitable there. For example, is it better to invest 5,400 rubles and get 500 or invest 7,800 rubles and get 600? ROI will help answer this question. In the first case, ROI = 9.3%, and in the second 7.7% (try to calculate it yourself). In the first version, more. It is more profitable. It turns out to be more profitable to invest these 7,800 in a place where they give 500 rubles for 5,400. In this case, we will get 722 rubles, instead of 600. And imagine, would you invest 100,000?

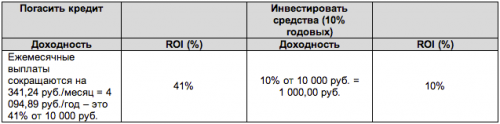

In the case of a deposit, everything is clear – how much money is earned, so much is income. That is, 10% of 10,000 = 1,000 rubles of income. Therefore, contribution ROI = 10%.

As for the loan, everything is somewhat more complicated here. We need to understand one simple thing. In fact, the income from this kind of investment will be a reduced amount of monthly payments. Because cutting costs leads to an increase in the amount of funds you have left. For example, you paid 10,000 on a loan, and began to pay 9,000. Profitable? Of course, even an extra 1,000 is nice. So, it's not the size of the payment amounts that matters, but the fact that you reduce them. In business, a simple approach is used: what is saved is earned. Apply it and you. The less we pay, the more money we have left for our needs.

So, what do we have with the loan. After making calculations (for example, with the help of a bank employee), we will establish that by investing 10,000 in our loan, we will reduce our monthly payments by 341.24 rubles. That is, we will receive additional income in the amount of 341.24 rubles. It would seem a little. But in a year (12 months), 4,094.89 rubles will already run up. That is, more than the contribution. Great! We can spend this amount for the next New Year or put them again to repay the loan. By the way, what's the ROI here? You can calculate it yourself. You will get it equal to 40.9% or 41% for an even score. Thus, it can be seen that, due to the reduction of payments, we get ROI loan repayment = 41% per annum.

In addition, there is another point that should be discussed. This is the amount of the overpayment on the loan. As a result of reducing the debt on the loan, the amount of overpayment will decrease from 52 thousand to 49 thousand rubles — more precisely by 3,157.72 rubles. This amount is saved, which means it is earned for the remaining 45 months (remember, we have been paying the loan for 15 months).

Thus, the monthly yield = 3,157.72 rubles / 45 months = 70.16 rubles / month. For a year = 70.16 rubles × 12 months = 841.92 rubles. This can also be considered an additional advantage of early repayment of the loan and indirect income from this investment = 8.4% (841.92 rubles / 10,000 rubles × 100%).

In total, the total return on early repayment of the loan = 4,094.89 rubles (reduction of payments) + 841.92 rubles (reduction of the amount of overpayment) = 4,936.81 rubles = 49%. Now we definitely have enough for the beginning of the New Year celebration!

So, how do we, mere mortals, choose an attachment?

1. If you already have free funds, then decide if you want to get additional income?

2. Analyze what investment options are available to you.

3. Determine in what form you will receive income from these investments? In the case of a deposit, this is the interest on the deposit, in the case of a loan, the amount of reduction in monthly payments and a reduction in the amount of overpayment on the loan.

4. Determine the amount of income. In the case of a bank deposit, this is the % on the deposit, in the case of a loan, a table or calculations by a banking specialist will help you.

5. Calculate the amount of annual income. While in rubles.

6. Calculate the return on investment (ROI). Divide the received annual amount of income by the amount of investment and multiply by 100%. You will get a percentage expression of the return on investment. The percentage received from different investments can be compared with each other, determining the most profitable investment.

7. Voila! Congratulations! You are on your way to wealth!

Personally, I calculated (and this is the key word here) that it is much more profitable to invest my free 10,000 rubles in repayment of the loan and get 49% per annum from this. I hope this article will help you to make the right decision in a difficult, but such a pleasant issue as investing. Manage your finances wisely. Turn on your wits :)

upd. By the way, we continued to study the topic of Personal Finance, already in a new article about the depreciation of money. Welcome!

———

You may be interested in other articles by the author:

Re-crediting: or how else to save on a loan?