You can listen to the article. If it's more convenient for you, turn on the podcast.

Many online platforms now offer to arrange a split, that is, to pay for the goods in parts. It is not always clear to users what this is — a modern offer to take out a loan or some other mechanism? Let's figure out how it works and whether it's worth using this tool.

Split payment, or payment in parts, is a system where the purchase price is divided into several equal shares. The buyer lists the first one immediately, and makes the rest later according to the schedule. It is convenient with expensive purchases. For example, by paying 20 thousand for a new sofa at a time, you can make a hole in the monthly budget. If you make 5 thousand each from salaries and advances, this will help save funds for mandatory needs.

At the same time, the split payment service is provided not by the store itself, but by a third-party BNPL service. The abbreviation has the very meaning — buy now pay later, that is, "buy now, pay later." Therefore, you can split it only in a store that cooperates with such a service. Sometimes a company interacts with several services, so that when buying, you can choose which one you like best.

At the same time, almost no additional effort is usually required from the buyer. When placing an order, you need to specify payment in shares, parts or splits and enter the following data:

You can pay for several items in installments at once until the limit that the service has set for the client is exhausted. The conditions depend on the service itself. We will talk about this below.

By default, no. You end up paying only the cost of the product. The service benefits from the stores, as they can count on additional sales thanks to such an installment plan.

Here are the most notable ones.

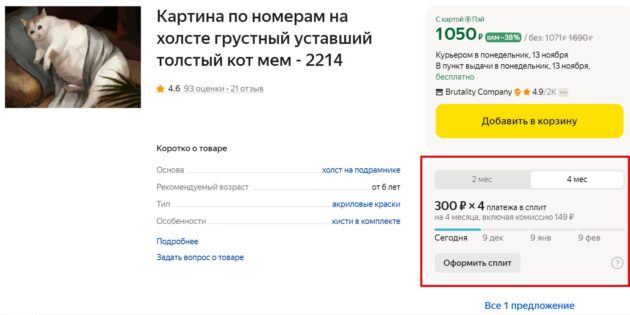

Yandex has two options: a free split for two months, or rather for six weeks, and with a commission for a longer period. The first one implies that the cost of the product is divided into four payments: the first one will be withdrawn immediately, the rest — every two weeks until the debt is repaid. The split can also be extended for four or six months, but for an additional fee. For example, when paying for a split item for 1,050 rubles for 4 months, you will have to pay a commission of 149 rubles.

The service divides the cost of the product into four parts. The first one is debited immediately, the rest — every two weeks. All without commissions. The limit is set individually, but most often for purchases in one store it is 30 thousand rubles.

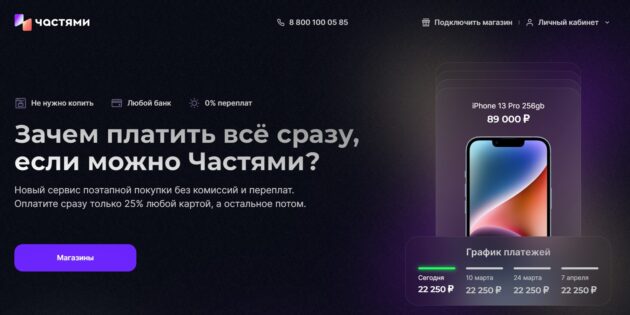

The payment scheme is the same as everyone else's: the amount is divided into four parts, the first one will be written off immediately, the rest every two weeks.

You need to make four payments within six weeks. The limit is set by the partner store, usually it is 30 thousand.

The standard scheme is four payments within six weeks. The limit can be found on the website.

Yes, everyone provides this opportunity. You can transfer the balance on the website of the service through which you made the payment in installments.

Yes, on the same terms as usual. The service will then simply transfer the money already paid to the card you specified when purchasing .

In "Shares", a fine is provided for late payment — up to 7% of the remaining debt. The sanctions are also discussed in the "Podeli", but they do not name the size. The rest indicate only that they will repeat withdrawal attempts. No other consequences are reported, but after a while the company can go to court and collect the debt through bailiffs.

The condition of all services is that the client must be of legal age. It is also important that the card is issued to the person who pays.

A logical question, because the mechanism is very similar. But a split is not a loan, and data about it does not get into credit history.

However, you should be more careful. For example, Yandex has an improved split, which offers to stretch payments for one or two years. But this is already a credit product, although it is presented on the same landing page.

Some services, in particular "Shares", "Shares" and "Parts", provide such an opportunity. On their websites, you can find lists of stores where the tool is available. You will need to pay with a card using a QR code, and the split system will be activated.

The advantages are clear:

The disadvantages are less obvious:

BNPL services are becoming more and more, accordingly, it is inevitable that sites will begin to appear that just want to rob gullible buyers. Therefore, it is better to be careful. However, if you follow the path when you find a product on the store's website and use the service with which it cooperates, it is quite safe. But to act on the contrary, that is, to look for a BNPL service and buy goods in installments from its website, you should be more careful. If we are not talking about understandable players.

Usually, the store itself publishes the basic terms on its website. But it's better to go to the service's page and read what they offer, so that there are definitely no surprises. Find out what the penalties are for delays, for example.