Today, Life Hacker will touch on a somewhat specific, but extremely relevant topic for everyone who has moved out of work for an uncle and forms their own financial well-being. Obviously, for the successful operation of e-business, it is necessary that the client can pay for your goods and services everywhere and always. As quickly as possible, simply, with a minimum of effort and movement, from anywhere in the world. We will consider an electronic payment system suitable for such criteria.

We will talk about a system called PayOnline. You are very likely to use it if you made purchases or even paid for something online, but now, when you sell yourself, you need to master this tool from the reverse side.

When it comes to money, first of all you need to make sure of the reliability of the partner: PayOnline is the official provider of Visa and MasterCard services, they have all the necessary security certificates, these guys themselves develop technological solutions that receive the status of the best in the relevant categories. The largest banks work with them. Everything is fine here.

We turn to the specific solutions offered by the company. Since we started the conversation with starting a business, first of all we will consider solutions for small, start-up companies. To implement the acceptance of all current types of online payments on the site there is a solution called Pay-Start.

What the business owner gets: the ability to accept payments from all types of bank cards, including the over-popular, but often out of business Maestro and Electron. A full package of current electronic services (WebMoney, Yandex.Money, QIWI Wallet). In the end, there are virtual bank cards from Beeline and Megafon (now a lot of people use them).

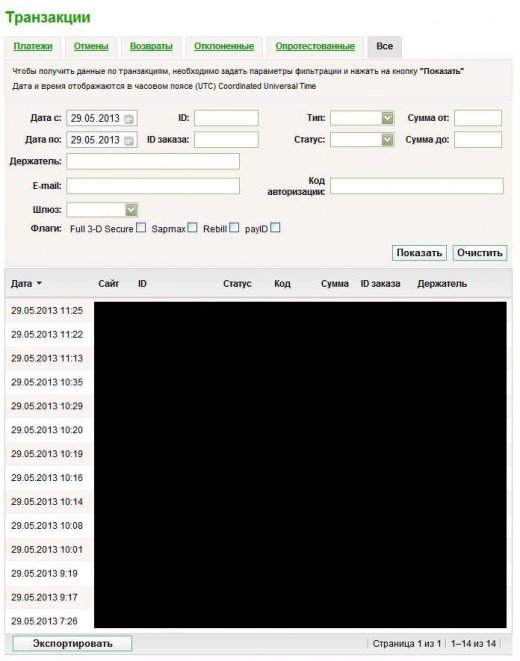

Money transfers are carried out using a reliable 3-D Secure protocol (all responsibility for payments is removed from your shoulders), and if necessary, all incoming payments can literally be "sorted out" using an analytics tool with all the necessary filters:

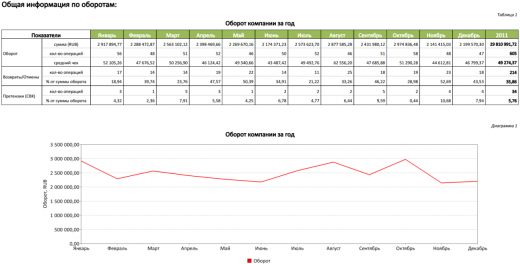

And this is what part of the annual report b looks like (it includes data on the company's turnover for the year, including with a division by country, banks, as well as transaction data):

Everything written above sounds very nice, but how does the system embed into the site in practice? Paper procedures are standard and do not require comments, but the technical side of the issues deserves attention.

Firstly, you probably won't have to configure anything further, because PayOnline has ready-made modules for the most popular CMS (Joomla, PHPShop, UMI.CMS, InSales, WebAsyst Shop-Script, 1C-Bitrix).

Secondly, the immediate launch of the system into "combat mode" takes place within just three days from the end of the bureaucratic red tape with documents, which is good news.

As a result, everything is formed into a fast, functional and convenient way to establish financial relations with customers. However, sometimes this is not enough.

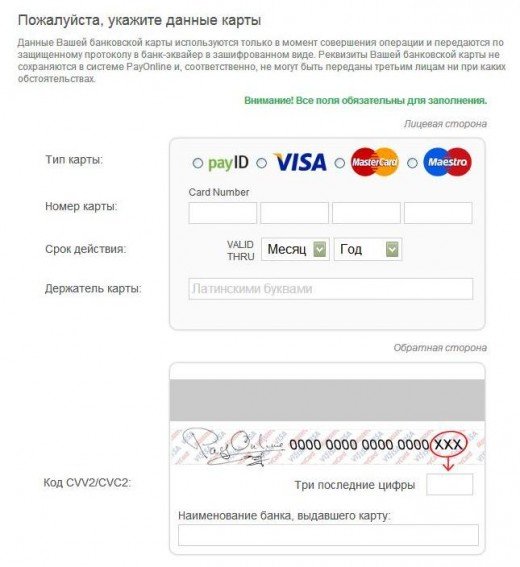

It is important to note that even a very good system from the point of view of functionality will not work well if the user sees from his side a curve and similar obscenities. PayOnline has a very beautiful standard payment form.

And even if the default design for some reason does not suit, you can always order a unique custom design that will fit perfectly into the site.

Anyone who has not yet encountered electronic payment systems in the role of a service provider has a pretty bad idea of the hell in which every buyer who is faced with any difficulty floods with angry letters and complaints… who would you think? Payment system operator? No, he will address you personally. For him, you (the person from whom he bought something) are equal to the one to whom he paid the money, and for him it is almost a personal transfer of money from hand to hand. He absolutely does not care that a completely different service is engaged in transferring money.

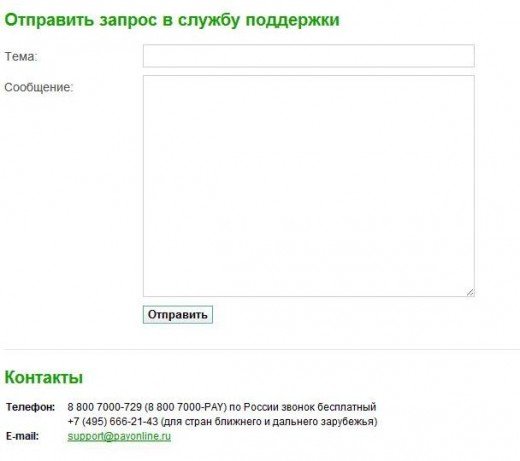

In this regard, PayOnline is good because it deflects the blow to itself. The payment form contains the contacts of the PayOnline call center (it is multilingual, round-the-clock and free), and their specialists already solve all problems with payments. The brain of the store owner remains intact, and if he himself has problems, then you can reach the support service directly from the personal account of the system.

At some point, the business owner realizes that more advanced tools are needed to work more efficiently. In this case, PayOnline offers a more powerful Pay-Standart solution.

It has everything that the launch version can boast of + several serious bonuses: working with transactions in real-time, the ability to pay "in one click", a full and partial refund system, support for automatic payments from cards (various services with a subscription fee and linked to time intervals), as well as the ability to verify the bank card holder by blocking an arbitrary amount with subsequent confirmation from the owner in conjunction with the option of pre-blocking the amount on the card with subsequent confirmation of payment by the payer. And you can also configure 140 security filters for the features of your online store.

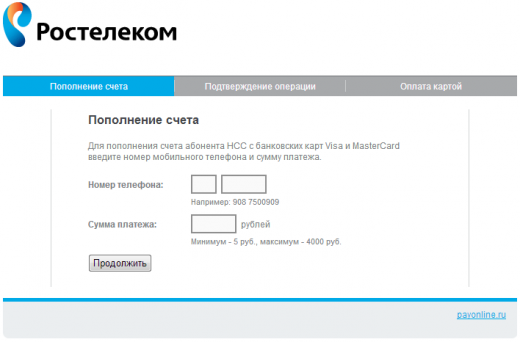

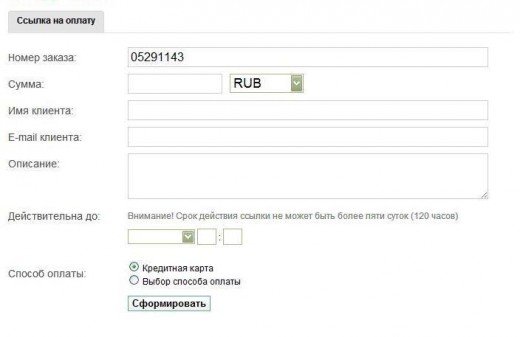

In fact, there is a benefit for both sides. The seller reduces his own risks, and regular and more demanding customers (and they will certainly be, and the further the business grows, the more of them) will have at their disposal more convenient and flexible payment methods with you. If necessary, the seller can even send the client a personal link to a payment for a certain amount:

And why not? The specifics of your business may involve paying directly inside your mobile application. So, we need a means to implement this option. PayOnline can do it.

Which one? Travel company/ticket sales? Does the business operate outside the Russian Federation? A reference point for mobile technologies? Do you need to work through terminals? Well, you understand.

Probably, it was worth shedding light on this topic right after "Security", but it will be fine as it is: PayOnline has an open and transparent calculator for calculating the commission for their services. We simply indicate the direction of the business, the approximate turnover for the month, as well as the country (Russia / not Russia). The calculator will immediately give you a percentage of the commission. This is not a perfectly accurate figure, it may differ slightly depending on additional factors, but it allows you to calculate the expediency of contacting this particular service, and this is very honest with customers.

In general, PayOnline is presented as a flexible and functional solution for organizing an electronic payment system within a business of any scale. The availability of "small to large" options, as well as specialized options for specific types of businesses, make the system truly universal. In a short period of time, the business owner gets what he needs — a democratic commission in exchange for the opportunity to purchase his goods and services in all relevant ways from anywhere in the world. What else is needed?

PayOnline.ru →