In April 2021, the State Duma adopted the law Federal Law No. 88‑FZ of April 5, 2021 "On Amendments to Article 219 of Part Two of the Tax Code of the Russian Federation regarding the Provision of a social Tax Deduction in the amount paid by the taxpayer for the sports and recreation services provided to him" , which introduced a new tax deduction. This is the amount from which the state allows not to pay personal income tax or to return part of the money if personal income tax has already been paid. This deduction can be issued if you have spent money on physical education and sports.

The deduction is due to everyone who pays personal income tax at the rate of 13%. Accordingly, it is necessary to be a resident of the Russian Federation, that is, to spend more than 183 days a year in the country. Non-residents deduct personal income tax at a different rate and do not have the right to deduction.

Those who receive an unofficial salary, work as a self-employed or sole proprietor on a simplified taxation system will not issue it either. They do not pay personal income tax.

Compensation for fitness costs is provided to those who have paid for physical education and wellness services for themselves or their minor children. But not any, but those that meet several criteria.

The list Order of the Government of the Russian Federation dated 09/06/2021 No. 2466‑r the government approves. Now there are three types of physical education and wellness services:

The Ministry of Sports annually updates and publishes on its website a list of organizations and entrepreneurs that provide physical education and wellness services. A fitness tax deduction can be issued if you have interacted with someone from the list.

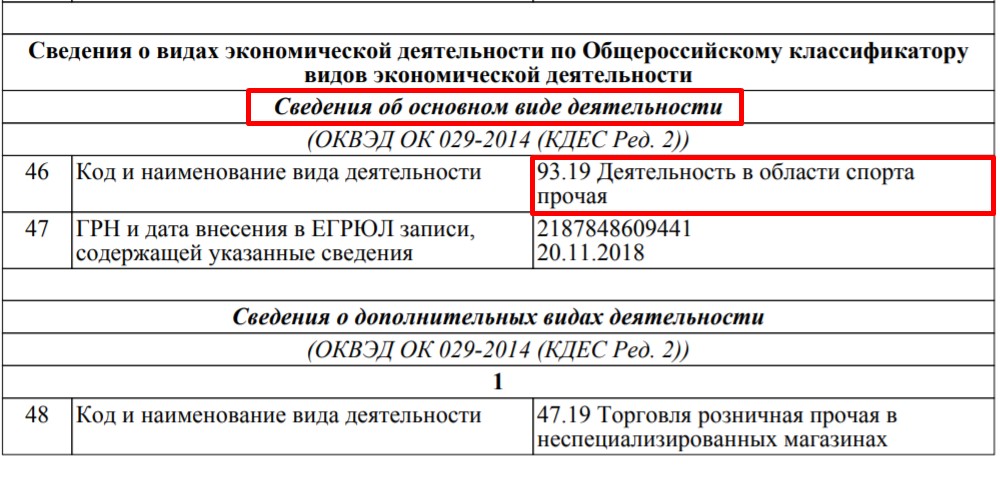

For a company or entrepreneur who provides physical education and wellness services, this activity should be the main one. You can check this on the tax service's website if you find an organization or sole proprietor in the official register and see the main type of activity.

The deduction for sports has been added to the number of social. The maximum for them is 150 thousand rubles. And not for everyone individually, but for everyone. Accordingly, if you spent 120 thousand on training and another 50 thousand on fitness, then the maximum deduction will still be 150 thousand, not 170 thousand.

It should also be borne in mind that you will receive only 13% of the deduction amount on your hands. If you spent 150 thousand or more, you can return 19,500. If you spend 50 thousand rubles, you will be paid 6,500 rubles.

The tax service is waiting The law on the introduction of personal income tax deduction for physical education and wellness services has been adopted / Federal Tax Service two documents:

If you receive a deduction for the child's activities, it is worth confirming the relationship with a copy of the birth certificate or adoption.

This material was first published in August 2021. In January 2024, we updated the text.