I think that many of you have heard about the 10% rule – this is when you necessarily set aside 10% from everyone, even the smallest income. It is not always easy to adhere to this rule, but if you get used to it, quite impressive sums accumulate. Especially if the income is good.

For those who do not believe in all these deferrals in percentages, I suggest starting with at least 1%. Just like that, it's hard to imagine on your fingers how the amount of your savings will change over a long time if you increase your fund in the piggy bank by at least 1%. 1% is a very small figure, but even it can help you accumulate decent capital over time.

In order to see your future profits, you can use «The 1% More Savings Calculator».

The calculator takes into account such values:

1. Your annual income.

2. The amount saved at the moment (current savings balance).

3. The percentage that you save each year.

4. Annual growth of your salary in %.

5. Percentage of expected annual profit.

6. Time interval.

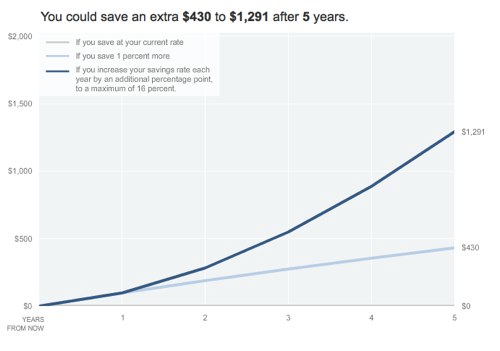

After entering all the values, three curves are displayed on the graph. One shows you what your savings will be if you don't change anything, if you add at least 1% every year and if you increase the percentage of savings to the level of 16.

Even if you have not postponed anything before and it is difficult for you to predict the growth of the money you receive for a long time, try it anyway and you will understand that it is still better than nothing at all. For example, starting from $ 430 to $1,291 for 5 years with zero parameters of items #2, #3, #4 and #5 and an annual income of about 10,000.