This is a card with which you can pay only with your own money in your account.

This material contains maps with free maintenance. But this is not the only important criterion that may be of interest. To find the best deals, we also took into account the following factors:

This is not a rating, but a list, so the order of the offers does not matter. At the time of publication, the maintenance of these cards is free of charge, without any conditions.

Cardholders are awarded cashback of 1% for everything and another 5% in three categories to choose from. They promise to return up to 33% of expenses for purchases from partners. The maximum cashback amount is 5,000 rubles per month.

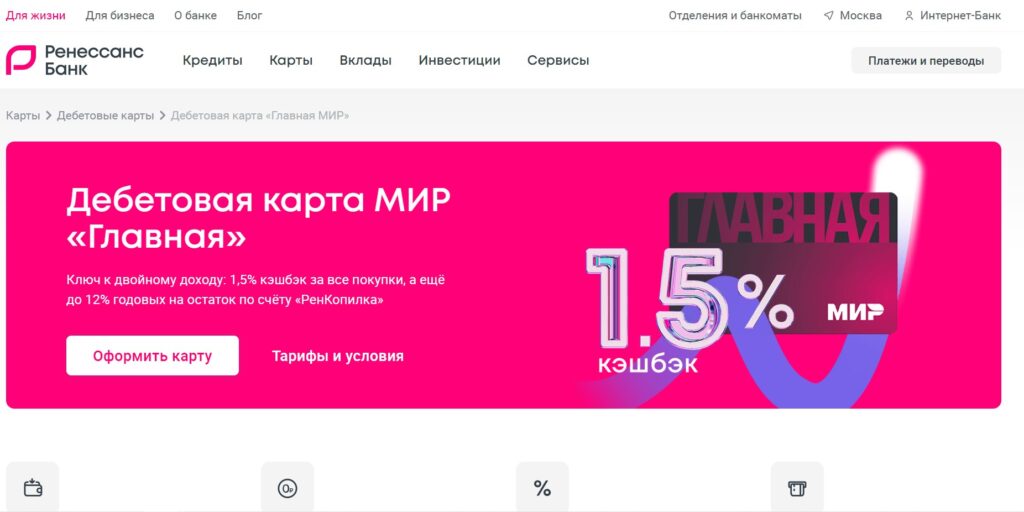

Cashback of 1.5% is accrued on all purchases, and with a subscription — 2%, which are then returned in rubles to the card. The package promises free insurance, which also applies to spouses.

The loyalty program can be selected each month from several options:

They promise a 10% cashback on everything in the first two months and 2% later on spending on transport and taxis, cafes and restaurants, supermarkets. However, we are not talking about rubles, but about bonuses that can be spent on goods and services within the framework of the Multibonus bank program. They can be used to pay for purchases or exchanged for rubles at the rate of 1 point = 85 kopecks. No more than 2 thousand multibonds will be credited per month.

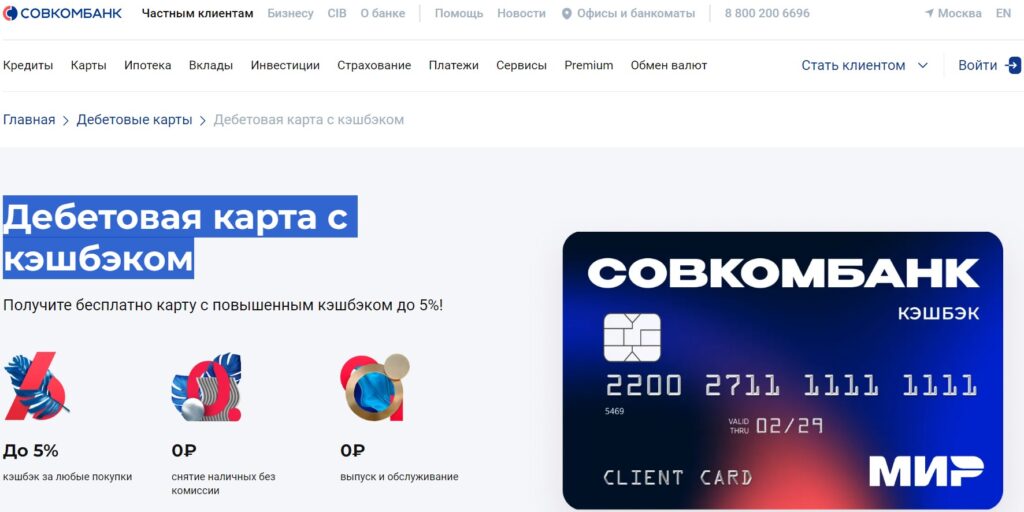

There is a cashback of up to 5% in three categories to choose from and up to 35% from partner expenses. By subscription, you can receive a 5% refund on online purchases.

In general, this card can be issued in rubles, dollars, euros and yuan in the payment systems "Mir", UnionPay. But for free — only the ruble "World". The cashback system is allowed to be selected. One option is to return 1-4% of all expenses, the amount depends on the amount of expenses per month. The second one is 0.5% cashback for everything and 5-15% in certain categories.

Cardholders are promised cashback from 1 to 15% in selected categories and up to 30% when purchasing goods from partners. You can get no more than 3 thousand points per month. They are then exchanged in the bank's application for rubles. But there is a limitation: the option is available when accumulating from 500 points.

Cashback — 1.5% on everything. You can also withdraw cash for free from ATMs of absolutely any bank in Russia.

A cashback of 5% is provided for spending in restaurants and cafes, 5% in hardware stores, 5% in clothing and shoe stores and 1% on other purchases. And SMS notifications are free on this card.

There are four reward options, from which the user can choose one each month. Here they are:

Points can be spent at the rate of 1 point = 1 ruble or exchanged for money on the account at the rate of 1 point = 80 kopecks.

This material was first published in August 2020. In October 2023, we updated the text.