From whom else to listen to advice about money, if not from one of the richest people on the planet? When the famous billionaire Warren Buffett acquired Berkshire Hathaway in 1964, its value was $19. By the end of last year, it was already worth $114,214 and has maintained a growth rate of 19.7% per year for the past 48 years. Judging by the way Warren Buffett manages his money, he should be trusted in this matter. And this applies not only to investments, but also to personal finances.

According to the famous billionaire, there are two simple mistakes in terms of personal finances that are very expensive for us. When the billionaire was asked what, in his opinion, is the main mistake, Buffett gave a simple answer:

Well, I think the biggest mistake is not to get used to saving from the very beginning, because saving is a habit. And the second mistake: trying to get rich quickly. It is easy to improve your financial condition slowly, but it is not easy to get rich quickly.

When it comes to money and investing, it's easy to fall into the trap and decide that savings can wait, and now the best option is to invest in new areas that no one knows about. Anyway, such thoughts are a big mistake.

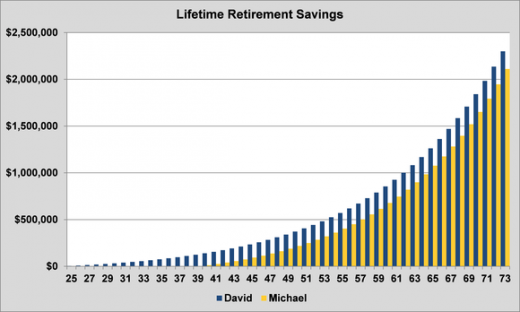

Consider the example of two 25-year-olds: David, who earns $40,000 a year, and Michael, who makes $80,000. Every year their incomes grow by 2.5% and they will work until the age of 73.

The only difference between them is that David started saving 10% of his income since he turned 25, and Michael decided to wait with savings until he turns 40, and until he earns $115 thousand a year.

And, of course, they do not keep money under the bed, but send it to the bank, for example, at 7% per annum.

By the time each of them turns 50, they will have set aside about $144 thousand for retirement. But when they retire at 73, guess which one of them will have more money?

Despite the fact that David has earned half as much money as Michael all his life, he will have 10% more funds. David will have $2.3 million in savings, and Michael will have $2.1 million.

And even more remarkable is that Michael invested 60% more of his money in savings than David (approximately $610 thousand was laid out from Michael's wallet, and $375 thousand - David)

If we imagine that their money will grow by 8.5% per year, in the end David will have 30% more funds than Michael — $3.7 million in reserve, compared to $2.9 million.

Very often, novice investors are told: "To make money, you need to have them first," but in order for them to appear, you need to save.

To as Buffett argues, it is important to get used to saving from the very first steps, and understand that wealth does not come immediately, but gradually, throughout life.