Taxes in general are a dense forest. And taxes on real estate and transactions with it are a dense forest with mines. The peculiarity of real estate is in large amounts. And an incorrectly made decision entails huge taxes or expenses in its amounts. This happened to Andrey, who "lost" 130 thousand rubles on this. Mom gave him a share in the apartment. It's definitely nice. But due to the lack of knowledge in this area, they conducted the transaction through a gift agreement, and not through a sale agreement. And now, in order to sell his share to him, he has to pay a tax of 130 thousand rubles. Although the tax could be zero. Not quite clear? Right. Therefore, today we will try to understand whether there are so-loved life hacks and "buns" in this matter.

In this article we will talk, first of all, about the Personal Income Tax (Personal income tax) and about transactions with apartments. I immediately indicate that now we will discuss the general scheme of real estate taxation issues. In future articles, we will analyze the individual points of today's question. According to the specifics and peculiarities of your case, it is better to consult a tax consultant in your city, and preferably even in your area, about the practice adopted by the tax inspectorate.

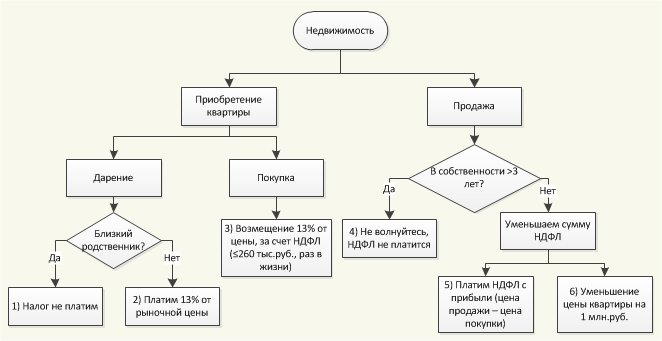

Let's try to figure it out in general. For each item of the scheme marked with a digit, a transcript is given below, indicated by the same digit. By clicking on the image, you will enlarge it.

Let's start in order, apartment purchase:

1) Donation. You were given an apartment. Great! According to Article 217 of the Tax Code of the Russian Federation, income received as a gift is exempt from taxation if the donor and the donee are family members or close relatives in accordance with the Family Code of the Russian Federation (spouses, parents and children, including adopted, grandparents and grandchildren, full-born and incomplete (i.e. having common father or mother) brothers and sisters). Here all these people in the case of donation do not pay tax. But keep in mind! If you are given an apartment by a relative who has owned it for more than 3 years, it is better that he sell it to you. Why? We will understand in paragraph 5.

2) The rest pay 13% of the total market value of the property. Any state does not really like freebies.

3) In this way the state compensates us for the cost of buying an apartment and stimulates the real estate market. Its essence is that once in your life you can be reimbursed 13% of the cost of the apartment, but no more than 260 thousand rubles (that is, no more than 2 million rubles from the price of the apartment – if the apartment costs more, then the amount of compensation is still 260 thousand rubles). This bonus can be used only once in a lifetime. All these benefits have one dubious side. The money is not paid to you immediately. Moreover, they are paid at the expense of the amount of personal income tax that you paid for the year. And more than one year. For example, you bought an apartment for 2.3 million rubles. Firstly, the maximum price of an apartment for reimbursement = 2 million rubles. It turns out the amount to be reimbursed = 13% of 2 million rubles = 260 thousand rubles. Next, your official salary is 5,000 rubles/month. It turns out that your monthly personal income tax = 650 rubles (13% of the official salary), and your annual personal income tax = 7,800 rubles. So, at 7,800 rubles, you will be paid these 260 thousand rubles. Count for yourself how many years) Therefore, it is reasonable to do it if you have a high "white" salary.

Apartment for sale:

4) This is the main life hack. Owning an apartment for more than 3 years frees you from personal income tax for the sale of an apartment. The date of the beginning of the countdown is the date of entry into ownership indicated in the certificate of registration of ownership.

5) In this matter, everything is quite simple – You pay tax on the difference between the sale price of the apartment and the amount of expenses incurred to purchase it. Therefore, oddly enough, your task is to increase the documentary value of the apartment when buying and lower it when selling. To pay less tax) But don't get carried away. The tax service may charge additional tax based on market prices for such apartments. It is usually recommended not to overstate/understate the price by more than 20%. In the event that you were given an apartment, then you pay tax on the full cost of the apartment. Therefore, it is better not to give apartments to relatives, but to sell them)

6) The state gives us this pleasant opportunity once for each property. Its essence is very simple – 1 million rubles is deducted from the sale price of the object, the remaining amount is taxed 13%. That is, you sold the apartment for 2.5 million rubles. Only 1.5 million rubles are taxed (2.5 million-1 million rubles). In the event that the price of an apartment is less than 1 million rubles, then personal income tax is not paid at all. Note that the deduction is not tied to a person, but to an object! If, for example, you own only 50% of the apartment, then you are entitled to only 50% of the deduction, that is 500 thousand rubles.

In general, you need to remember that only one approach of your choice can be applied to one object when buying / selling – the one that is more profitable. In the following articles, we will analyze each case separately in more detail. And in the comments to the article you can ask the questions you are interested in, which we will also try to answer)